fix it

build it

fund it

Your Credit Comeback Starts Now

$

Your Credit Comeback Starts Now $

Bad Credit Keeps You Broke

Let’s be real — bad credit can make life feel stuck.

You get denied for things you know you could afford. Your business dreams stay on hold because the banks say “not yet.” And it’s frustrating, embarrassing, and exhausting trying to figure it all out on your own.

The truth is, good credit opens doors.

Personal loans, business funding, better cars, nicer places to live, even peace of mind — it all starts with your credit.

How We Help You Bounce Back & Get Approved

Whether your score’s in the 400s or you're just tired of getting denied, I built this platform for you.

Inside my DIY Skool community, you'll learn how to:

Clean up your credit reports the right way

Add powerful accounts to build your score fast

Set up your business so lenders say yes

Get funding — even if you’ve been denied before

And if you’re too busy or just want it done for you, we’ve got that too.

You don’t need perfect credit to start.

You just need a plan — and that’s exactly what we give you.

how we help

DIY Credit Repair + Business Credit Course

The perfect starting point if you’re tired of getting denied and ready to take control.

Most people are never taught how credit really works. So when you start getting denied — for credit cards, business loans, even apartments — it feels personal.

But here’s the truth: it’s not your fault. You just didn’t have a system.

That’s exactly why I built the Skool Community — a low-cost, high-value space where everyday people are learning how to fix their credit, build it the right way, and set up their business to finally get funding.

What You’ll Get Inside:

Step-by-Step Credit Repair Blueprint

Freeze secondary bureaus, clean up personal info, dispute negative accounts, and fix your profile without paying $1,000+ to someone else.DIY Business Credit Buildout

Learn how to structure your LLC for funding, get net-30 accounts, and build a credit-ready business that lenders want to say “yes” to.Templates, Letters, and Tools

Instant access to pre-written dispute letters, credit-building worksheets, funding trackers, and more — no guesswork.Community Access + Live Credit “Happy Hours”

Get support from other members, ask questions, share wins, and join live sessions where we answer real credit questions in real time.

Done-For-You Credit Repair + Business Credit Buildout

Let Us Handle the Hard Part — So You Can Focus on Getting Funded

You’ve taken the first steps. But maybe you're overwhelmed, busy, or tired of trying to figure it all out alone.

That’s where our Done-For-You service comes in — we’ll handle the messy credit disputes, build out your business credit the right way, and walk you through exactly how to get approved for personal and business funding.

What’s Included:

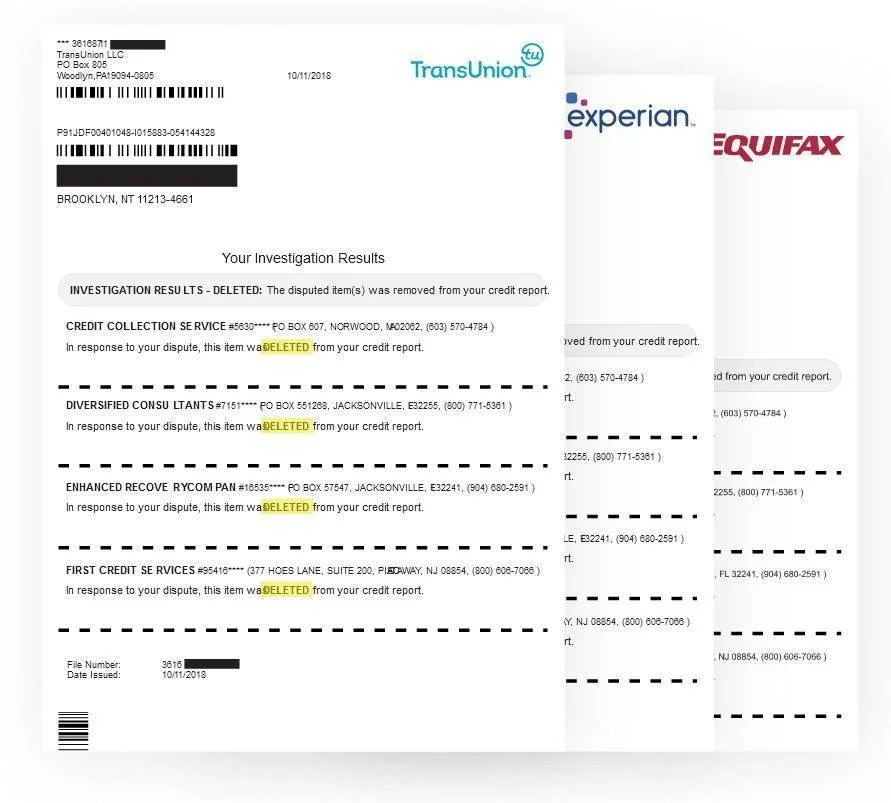

We pull your reports and clean up inaccurate, outdated, or unverifiable info

Our team sends professional dispute letters backed by consumer law

We track every dispute and provide updates along the way

Business Credit Buildout

Set up or clean up your LLC so it’s fundable (compliant address, business email, domain, phone number, etc.)

Guide you through opening key net-30 accounts that report to business bureaus

Build a strong Paydex and Experian Business score

Funding Prep

Position your personal and business credit to qualify for $10K–$100K+

Strategy call included to match you with the right banks, cards, or lenders based on your profile

Soft-pull prequalification strategies + lender matrix provided

VIP funding fast track

Get the Credit. Get the Capital. Get a Funding Partner in Your Corner.

You’ve fixed your credit. Your business is set up. You’re ready to get serious about stacking approvals and unlocking capital. But you don’t want to guess. You want real strategy, real bank connections, and a guide who’s done this before.

The VIP Funding Fast Track is our top-tier, all-in offer — where we work with you 1-on-1 to maximize your personal and business funding using the exact strategies banks don’t want you to know.

This isn’t a course. It’s a customized blueprint and partnership — from credit to capital.

What You’ll Get:

Deep analysis of your credit reports + scores

Business credit profile audit (Experian Biz, D&B, Equifax Biz, PayNet)

“Fundability” checklist to patch gaps BEFORE applying

Custom Funding Strategy

No templates — this is tailored to your goals, income, and credit profile

We match you with the right lenders, banks, and funding programs based on your risk profile

You’ll know what to apply for, when to apply, and how to avoid hard inquiry traps

Access to Our Banking Relationships

Warm intros to real business banking reps that help push your approvals

Leverage insider knowledge on which banks are currently approving and how to maximize limits

Use our funding sequence strategy to stack $50K–$250K+ without red flags

Weekly 1-on-1 Calls + Priority Support

Talk directly with Chase and the funding team

Ask questions, share results, and stay accountable with real-time feedback

Get direct help with applications, documents, and approval strategy

MEET Chase

A few years ago, I was in the same position as many of you — stuck with bad credit, denied for everything, and wasting money on credit repair companies that overpromised and underdelivered.

After getting burned one too many times, I decided to take matters into my own hands. I studied consumer laws, credit strategy, and the entire credit system. I went from a 400 credit score to an 800, and it changed everything.

Since then, I’ve used credit to fund multiple businesses that now generate passive income through Turo and real estate — and I’ve made it my mission to teach others how to do the same.

I built this platform to give you the tools, support, and strategies I wish I had when I started.

Let’s rebuild and level up — together.

CHOOSE A PLAN

DIY Credit Repair & Business Funding

$29

Monthly Community Subscription

DFY Credit Repair & Business Set Up

$2,997

One time or 3 payments of $1,250

VIP funding fast track

$6,997

One time or 3 payments of $2,750